It seemed like a glimmer of hope in the dark days of pandemic – the federal government offered free money in the form of CERB (Canada Emergency Response Benefit) to help Canadians who lost income. The application process was easy and many people across the country received the benefit in 2020, including some pensioners.

Those eligible could have received $500 every seven days for up to 28 weeks. But what they may not have known is the CERB is taxable income and, if it was later determined that the recipient was not eligible for the CERB, it would have to be repaid.

When the CERB expired in 2020, the CRB (Canada Recover Benefit) was introduced. That, too, is taxable income and is expiring in late 2021.

What some of the lowest income pensioners may not have known is that their CERB benefits in 2020 could affect their pensions in 2021 as the federal government ‘clawed back’ the benefits by reducing the Guaranteed Income Supplement (GIS) portion of their pension.

The GIS is a monthly benefit available to low-income seniors. The amount of the benefit is based on your annual income and is adjusted when your taxes are filed.

Following the latest tax season, some Nuu-chah-nulth seniors began reporting that their pensions were coming in short by several hundreds of dollars beginning July or August.

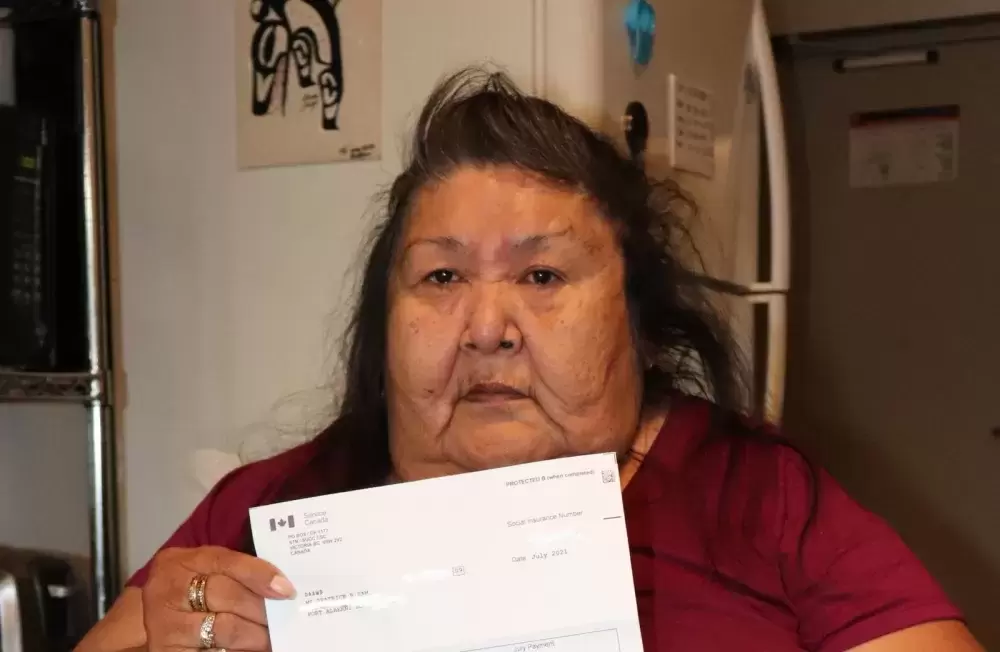

“I had $500 taken off of my pension last month,” said Ahousaht elder Beatrice Sam. Disabled, Sam lives in an independent living apartment at Tsawaayuus Rainbow Gardens in Port Alberni.

Many of those seniors are afraid, wondering how long the reduced pension benefits will be in place and why it is happening. More importantly, they are wondering how they will make ends meet until next summer. Some worry they will become homeless without enough money to pay rent.

“This is scary for elders,” said Sam. “We don’t get much to begin with.”

NDP MP Daniel Blaikie was re-elected in his riding of Transcona, Winnipeg. He has served as the Critic for Employment, Workforce Development and Disability Inclusion. He began raising the issue with Liberal Cabinet members as the snap federal election was called earlier this summer.

Blaikie noted that people were not warned about this claw back.

“Nobody told them to hang onto this money because it would be needed the following year…it should have been written in bold type on their letters,” said Blaikie.

The federal government explained in an email to Ha-Shilth-Sa that any earnings considered to be net income under the Income Tax Act is used to determine the amount of GIS. The GIS is a benefit used to top up the pensions of very low-income seniors.

“Pandemic-related benefits, such as the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit, are considered taxable income. These benefits are therefore considered income for GIS purposes,” wrote Saskia Rodenburg, Media Relations Office, Employment and Social Development Canada, in an email.

“A person’s GIS entitlement is re-calculated at the beginning of each payment cycle, which runs from July to June, and is based on the previous year’s income,” Rodenburg added.

She went on to say that every year in July seniors have their GIS adjusted to reflect changes in their net income.

“This ensures the benefits go to the most vulnerable seniors,” she said.

In order to qualify for GIS, you must be Canadian, age 65 or over and collecting OAS. If you’re single, widowed or divorced, your maximum annual income is $19, 248. If you have a spouse or common-law partner, your combined maximum income is $25,440 if your spouse receives OAS and $46,128 if they do not receive OAS.

MP Blaikie objects to the claw back. Seniors received these funds in an extraordinary circumstance and now their incomes are decimated, he said.

“We’ve asked the government to consider the CERB extraordinary income and not count it in the GIS calculations,” said Blaikie.

“All seniors on GIS live in poverty,” he noted. “There’s going to be a lot of homeless seniors, and this doesn’t serve anybody.”

According to Service Canada, if a senior applied for and received the CERB or CRB and it caused a reduction of the GIS portion of their monthly pension cheque, the reduction will remain in place until July 2022, after the next tax season.

But there’s a chance that pensioners affected by the cutback may have their GIS recalculated.

“GIS clients who received CERB benefits delivered by Service Canada under the Employment Insurance Act may be able to have their GIS benefit paid based upon their estimated income for the current calendar year rather than based upon their actual income from the 2020 calendar year if their pension income has reduced or their employment income has ceased due to retirement,” says Service Canada.

They go on to say that this is not the case for CERB and CRB delivered by the Canada Revenue Agency.

People who received the CERB or CRB benefits under the Employment Insurance Act and wish to have their GIS benefits recalculated based on their estimated income for the current calendar year are advised to contact the Old Age Security call centre at 1-800-277-9914.

But Blaikie said the government seems determined to cling to the claw back. Now that the election is over, Blaikie is waiting on a cabinet shuffle. He plans to continue to pressure the Liberal government to stop the claw backs on Canada’s most vulnerable citizens.

As for settlements received through the Federal Indian Day School class action lawsuit, seniors can rest easy knowing that their pension is safe in this case.

According to the Federal Indian Day School website, payments from the Settlement Agreement provides that there should be no impact on benefits, including social assistance, OAS, and CPP.

“The Canada Revenue Agency makes it clear that litigation damages for personal injuries are not taxable income. Further, they will not impact social benefits,” reads the Federal Indian Day School website.

That includes the Canada/Quebec Pension, Old Age Security (OAS) and Guaranteed Income Supplement (GIS).

“Litigation payments for personal injury, including psychological harm, are exempt from the Canada Revenue Agency’s definition of income,” continues the website. “The OAS pension is a monthly payment available to seniors aged 65 and older who meet the Canadian legal status and residence requirements. Low-income seniors are also eligible for the Guaranteed Income Supplement which is added to OAS. Neither will be impacted.”

The federal government announced that they will increase the Old Age Security (OAS) pension by 10 per cent for seniors 75 years of age and over as of July 2022.

In addition, they will give eligible seniors a one-time taxable grant payment of $500. To qualify, the elder must be born before June 30, 1947, and be eligible for the Old Age Security pension in June 2021.