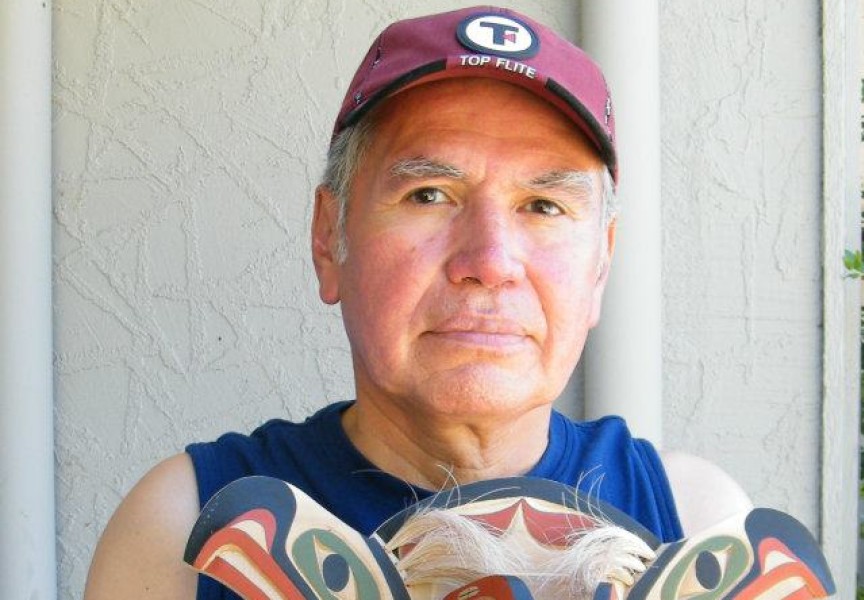

Ben Clappis received an alarming phone call on the morning of Dec. 6 when he was contacted by someone who said they were from border control services.

“They said they’ve got packages that are registered in my name, and it’s illicit drugs, as in cocaine, and then also marijuana,” recalled the Bamfield-area resident. “They’re saying that they found other bank accounts, I think in Toronto, an address in Surrey.”

The person identifying as a border agent asked for the proper spelling of Clappis’s name several times, as well as his date of birth. Although he initially believed the caller’s authenticity, Clappis became suspicious when the questioning persisted.

“They questioned me on credit cards. ‘Which bank do you deal with?’ ‘Which credit card do you have?’,” said Clappis.

At one point he asked the caller if it was a scam, but this became clear when the call ended abruptly after Clappis told the person he didn’t have any money to give up. Clappis then called the RCMP right away, who confirmed his suspicions of the telephone scam.

“We’re getting many, many calls on that scam,” said Sue Labine of the Canadian Anti-Fraud Centre, which collects data on telephone and email scams to help inform law enforcement.

Labine said the call Clappis recently received falls within one of the 35 scam types that the anti-fraud centre monitors, an approach that they consider to be extortion.

The Canada Border Services Agency warns that people do pose as their agents using email, text messages and phone calls, all with the intention of accessing personal information and receiving payments.

“The CBSA never initiates a request for your SIN and credit card number by telephone, text or email,” said the federal agency on its website. “If you receive a telephone call or an email asking for this information, or requesting money, it is a scam.”

Labine cautions people to not give personal information over the phone without verifying the request, but to wait at least 10 minutes before calling a bank or credit card company.

“Quite often the scammer could still be on the line,” she said. “They put on a recording of a dial tone, the person believes they’ve hung up and then the fraudster will stay on the line and answer the call pretending to be whoever it is they’re pretending to be.”

Often the intention is obtaining vital information about someone’s identity.

“They lose their identify, and in the end that’s what the fraudsters are after, so they can open up bank accounts or government benefits,” added Labine.

In some cases, scammers can alter the telephone’s call display to identify as the CBSA or its employees.

“The CBSA may call recipients/importers to clarify package declaration details,” said the agency. “[H]owever, if you receive a call telling you that you must pay duty and taxes on a package that the CBSA is holding and threatens penalties, including jail time, beware that this is a scam.”

According to the Canadian Radio-Television and Telecommunications Commission, caller ID can be legally altered in some cases, as in when a call centre identifies as the client it represents, or when a doctor will use a hospital’s phone number while calling a patient. But in other cases what is known as “caller ID spoofing” is illegal when the display intentionally appears as an unreachable number.

Clappis noticed that the scam caller used the odd digits of V206-1106-160-0099.

He notified people of the incident on social media, discovering that others had experienced telephone scams recently as well.

This fall two telephone scams robbed people of over $34,000 in southwestern Manitoba.

One call appeared to be from border services, notifying the recipient that a package in their name had been intercepted.

“They claimed the package contained drugs, money and fraudulent documents,” stated the Winnipeg RCMP in a press release from Oct. 20. “The victim had recently placed some Amazon orders and was awaiting their delivery, which made it believable and concerning.”

More calls were made to the victim by someone identifying as a police officer as well as Revenue Canada.

“The victim was advised to send monetary payments to settle the issue, which the victim did,” noted the RCMP. “In the days following, the victim continued to receive phone calls requesting more money and realized it was a scam and called the police.”

Another victim from Manitoba heard from someone impersonating a police officer, claiming a family member was in a car accident and being held at the police station.

“The caller requested that the victim send money in order for the family member to be released from police custody,” said the RCMP. “After the money was sent, the victim followed up with another family member and realized it was a scam and called police.”

From Jan. 1-Nov. 29 this year the Canadian Anti-Fraud Centre received 6,143 reports of scams, resulting in $11,776,812 being taken from the victims.

But this represents a small sample of a Canada-wide problem.

“We do get less than five per cent of reports, people are just not reporting scams for various reasons,” said Labine. “They’re from overseas for the most part.”

Nationally, over the first nine months of 2021 a total of $120.4 million was lost to scams, according to the anti-fraud centre.

Those who receive calls from an unknown source are advised to not disclose personal information or feel pressured to send money before doing their own investigation. No police or government agency will ask for monetary payments by mail, wire transfers, cryptocurrency or QR codes.

If you believe you’ve been targeted by a scam, reports can be directed to the Canadian Anti-Fraud Centre at 1-888-495-8501.